HOW TO PREPARE

WHAT TO BRING

In preparation for your appointment, read the following:

- You’re in safe hands with Accrue Real Estate

- A financial feasibility study is being prepared for you

- Conditional: Advantage Consulting agrees to cover $275 appointment cost

- Document Checklist: What to bring to appointment

- How to prepare for a Zoom online appointment (if applicable)

- Accrue Real Estate Location (Melbourne/Brisbane)

You’re in safe hands with Accrue Real Estate

Whether you’re a first-time investor or have an established portfolio, our clients often comment that:

- this appointment has vastly improved their property knowledge

- they wish they’d had this quality of information 10 or 20 years ago.

Your financial confidence and comfort is of the utmost importance to us so be reassured – you’re in safe hands.

A financial feasibility study is being prepared for you

Your financial figures have been forwarded to an independent financial consultant who is now preparing a

financial feasibility study for you to be presented at the appointment.

This is a great opportunity to:

- review your existing loan structure

- explore your financial growth options

- identify debt reduction strategies

Conditional: Advantage Consulting agrees to cover $275 appointment cost

The cost for the financial feasibility study and appointment is normally $275.

| If | Then |

|---|---|

| You attend an appointment with Accrue within 30 days of meeting with Advantage Consulting | Advantage Consulting agrees to cover the $275 cost. |

Document Checklist What to bring to appointment

Bring the following documents to your appointment (both parties).

Identification

One form of primary identification and one form of secondary identification.

Primary Identification

- Current driver’s licence

- Current passport

Secondary Identification

- Medicare card

- Credit card

PAYG Income

- 3 most recent payslips (consecutive dates)

- Group certificates (last two years)

OR

- Full tax returns including Tax Assessment Notices (last two years)

If self-employed

- Business tax returns (last two years)

- Personal tax returns including Tax Assessment Notices

- Interim profit and loss statement (as current as possible)

If Centrelink income

- Centrelink Family Assistance Payment Statements (Parenting/Family

Allowance – showing Parts A and B)

Other (if applicable)

- Home / investment loan statements (most recent consecutive 6 months)

- Credit card statements for all credit cards including interest free cards e.g.

Buyers Edge, Go (most recent consecutive 6 months) - Personal / car loan statements (most recent consecutive 6 months)

- Rates notice (most recent for all properties including existing investment

properties) - Superannuation statement

How to prepare for a Zoom online appointment (if applicable)

| Appointment Link | 10 minutes before appointment: You will receive email with Zoom appointment link. |

| Ideal Room | Quiet room with no distractions. |

| Preferred Device | Desktop/Laptop with camera and microphone. (Tablet or smaller can be used but not ideal). |

| Plug-in Device | Ensure device plugged in during appointment to avoid flat battery. |

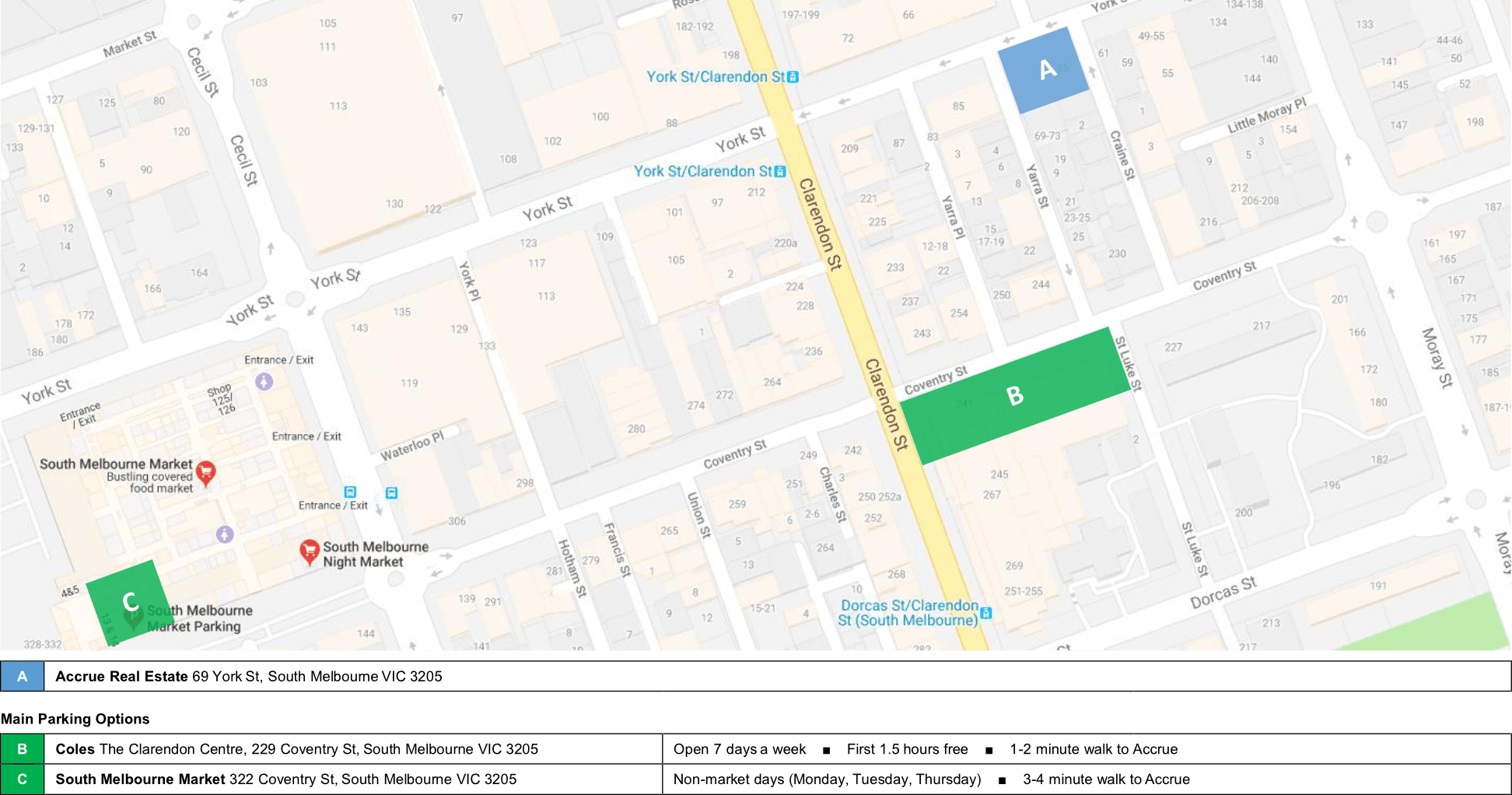

Accrue Real Estate Location (Melbourne): Head Office. 69 York St, South Melbourne VIC 3205

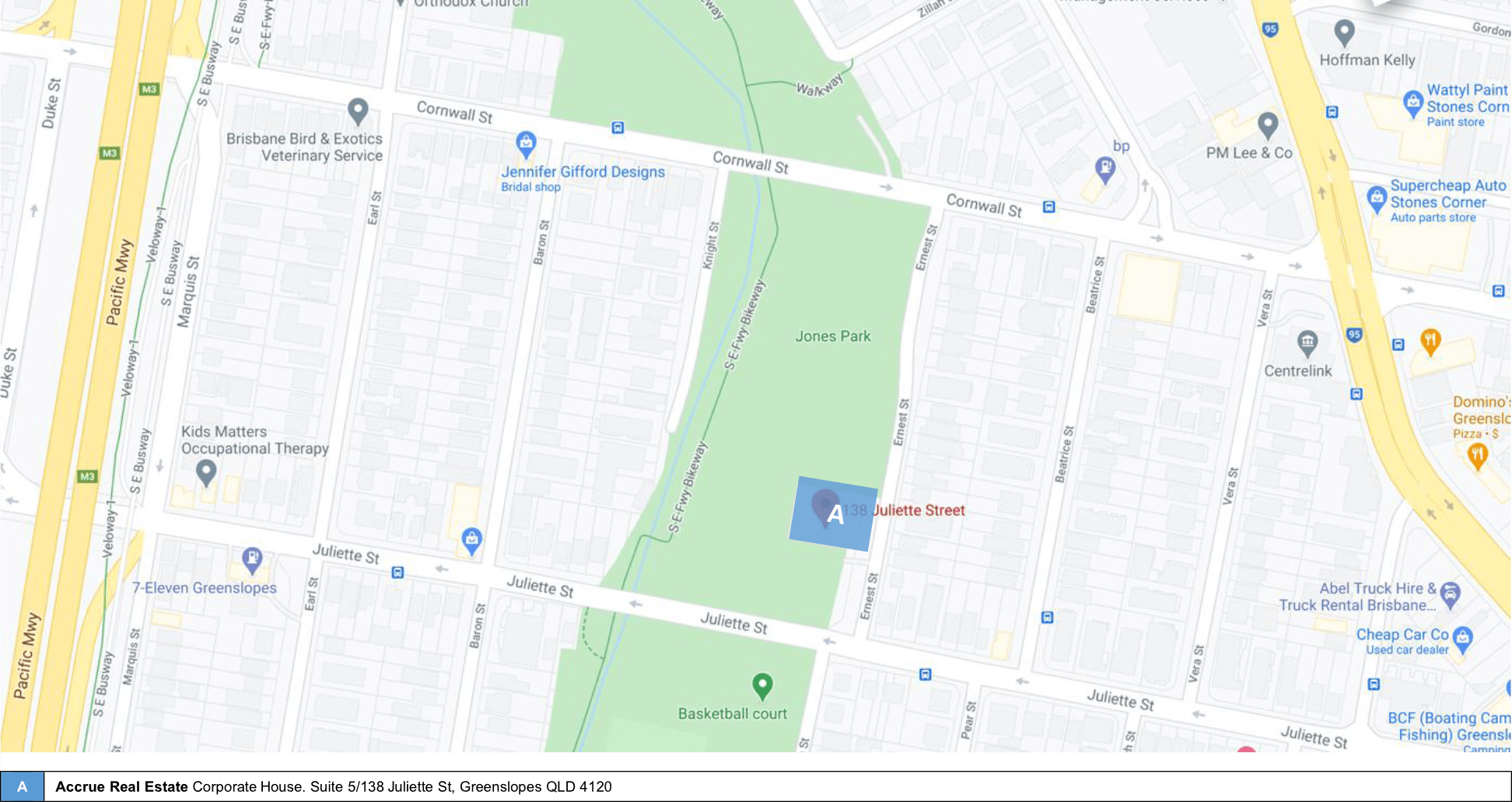

Accrue Real Estate Location (Brisbane): Corporate House. Suite 5/138 Juliette St, Greenslopes QLD 4120