Are you going backwards financially?

by Mieke Buchan

*If you’re not fighting inflation, you are!

Is your wage keeping up with inflation? The simple answer is, very sadly, no.

While our incomes have all stayed flat, or even went backwards over the last few years, the price of living has gone up. And we are all feeling it!

Surprisingly, you CAN make inflation price-creep work for you.

Let’s investigate!

$8.80 for a latte’!!!!

Lets look at the most extreme example of inflation in the news recently –

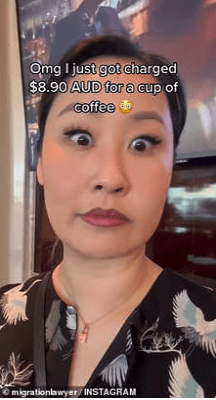

Melissa Chen – A Migration lawyer from Melbourne, was shocked when she was charged $8.90 for a soy latte at Barrangaroo in Sydney. What?!! We all expect a bit of natural price gouging to take advantage of cashed-up tourists– but, $8.90 for a latte’!!

Here’s how we get to $8.90 – Firstly, global supply chains have been impacted by Covid and the tragic scenario in the Ukraine. So, Aussie businesses have reduced access to coffee beans from around the world; which means the price of imported coffee beans goes up.

Also, wages in hospitality are going up – its really hard to get consistent bar and café’ staff around the country right now. So that all adds to the price of your latte’ too. And these factors aren’t changing any time soon.

If you want to know how to beat inflation, there are some excellent tips that will help. Keep reading

Petrol price nightmare

As much as it hurts, lets talk about the dollars the gas pump is guzzling from our wallets.

The situation in the Ukraine means the world is currently paying $120 US a barrel – when they were $20US a barrel in 2020, after Covid broke out!!

As oil prices rise, it impacts the cost of everything – transporting veggies from the country to our supermarkets is just one of them.

At the Aussie petrol pump, many households are reporting they’ll struggle to fill up their cars if prices stay over $2/litre. The only people this news is good for are the clever-clogs getting about in electric cars.

Surely there’s a way to get ahead of inflation?

Keep reading.

Your savings are shrinking!!

Its also vital to ask – are your savings keeping up with inflation? The simple answer here is also no. Your savings cash rate is sitting at around 1.3%. Meanwhile inflation is hovering around 4.9% – so your savings is making a net loss of 3.6% per year. All of that money you’ve worked so hard for is shrinking in value while it sits in the bank doing nothing. Your savings are now “losings”

Lets look at an example – your $120k in a savings bank account will increase to a net dollar value of $121,560 over a year

That’s 1.013 x $120,000 = 121,560

But, with inflation going up by 4.9% – your actual buying power is reduced

That’s .951% x $121,560 = $115,603.56

By doing nothing, you are losing almost $6000 a year!

You can do better! Lets find out how..

With the RBA’s cash rate at record low levels, the interest rate you’ll receive on the balance in your bank’s savings account is also at record low levels.

First solution – Consider a mortgage offset account instead of a savings account?

If you have a savings account on 1.3% and a mortgage with a 2.2% interest rate – By allocating money into your full offset account, you’d save more money on interest than you would earn in your savings account.

Additionally, interest on your savings accounts is subject to tax, whereas the interest-saving on your mortgage isn’t. So you’re paying down your mortgage faster AND saving on interest!

So how do I actually get ahead?

With inflation making life more expensive all round – how do we beat it?

Ask yourself, where are you actually doing ok? Thats easy – Your property! Demand for property around Australia is at an all-time high.

Depending on where you live, your home may have gone up somewhere between 3 and 30+% in 2020/2021 and into 2022.

Average home prices rose 13.5% in 2020-21 (according to property data company CoreLogic)

So your 650k house could now have a list price of $737,750 – $850,000. That’s incredible!

But – you don’t have to sell your house to take advantage of your new-found good luck. In fact, if you did sell – with all of the real estate fees and stamp duty, you might not be able to move into a house as good as the one you’re currently in!

The good news is – You can use your existing home equity to build your personal financial security by getting into an investment property.

Second solution – You can use your home equity to get into an investment property.

At the last Success Session, I had a great chat to Callan and Nestle Drumm. They thought they were nowhere near ready to get into an investment property – they’d hardly paid off any of their home loan. But in the last 5 years, their home in the western suburbs of Melbourne had gone up in value dramatically.

With a bit of guidance from one of the Advantage Money Mentors, they’ve invested in a new property development and are ecstatic about how easy it has all been. Their property is in a growth area and they have a guaranteed tenancy agreement. They also couldn’t believe the government incentives and tax benefits that were available to them!

Aussies just like you are already on their property investing journey.

In the first success session I chatted to Miriam Ellis, whose home beauty salon was shut down during Covid. Her husband Craig was working at a local sign factory. As a single income family, they thought they had no chance to realise their dreams of becoming property investors.

After learning how to reorganise a few of their debts, they were able to utilise the equity in their family home to get into their first investment property. They now own a townhouse on a golf course in Queensland!! Its growing in value, paying itself off AND they are receiving a tax benefit. It was so easy and stress-free, they are ready to jump into their next investment property now.

Its your turn!

Property is the safest asset that is capable of beating the inflation rate. Just like The Drumms and Ellis’s you could be so much closer than you think. Learn how to fight inflation by getting into an investment property too. Sign up for your fee-free and no obligation chat today

In Advantage News, our own Shelly Horton has shared the incredible journey of paying off her first investment property and moving onto her next one.

She started on her path to investing a little later than many people – but she’s now had an inspiring expedition from divorcing with debt to being financially secure, stable and excited about a comfortable future.

Safe as houses

The Advantage money mentors really are there for you. If you’re stressed about how to beat inflation, they believe the safest and most secure option is to increase your footprint in property.

The Advantage has helped thousands of Australians get ahead by using this exact approach. They can help you too.

There’s no need to worry about going backwards financially when you can take proactive steps today. Sometimes you just need a little financial education and guidance about whats possible.

A 30 minute initial chat is free of any fees or obligations, you’ll just find out what your options are.

Is an investment property starting to feel like a really good idea?

Find out how you can get on board!

Just pop in your details and we’ll show you how.