Where will your investment go when you do?

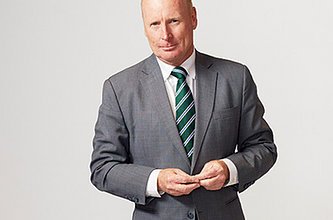

by Ross Greenwood

Don’t let the ghosts of your past mess with your afterlife – Get a will!

*And you can forget about leaving your dough to Brad Pitt.

There’s little doubt that at some time in your life, someone has told you to get a will. As you get older, people tell you all sorts of other things: get a skin cancer check; a colonoscopy; an endoscopy; and every other check in the world. Getting older sure sounds like it has a lot going for it, right?

Anyway, back to wills (those other checks are to make sure you don’t have to use your will sooner rather than later). You need one. If you have kids, and don’t have a will, how dare you. If you have an ex long-term lover; a former spouse or a fractured relationship with immediate family … you need a will. In short, get a will.

If you have those other things (the former lovers, spouses etc) you will most likely need something else: a testamentary trust. While you might say: “If I’m dead, what do I care?” the people who you care about will be left to deal with the stress of your disorganisation.

Far better to spend the modicum of time (and money) to set things up exactly the way you want to. It also makes certain that all those ghosts of your past don’t jump out of the ground and start haunting the ones you love (and to whom you would prefer your money to go).

The will is important because it is a legal document that spells out exactly how your assets will be distributed. It’s straight-forward. Dying without one makes things harder; for people you might not want to have a claim over your worldly possessions might have a legitimate claim (ex-spouses, in particular).

Now to the testamentary trust. In a perfect world, you would spend your last dollar and die. It doesn’t work that way. What you could do is sell all your assets while you are alive and give them to your family and friends. That’s nice, but silly because you will pay capital gains tax on all the shares and property you sell … and your loved ones will get less.

A testamentary trust is something that ends up holding all your assets if you die. That way, capital gains tax is not triggered by your death. Your loved ones can continue to earn an income from that trust and if, in future, assets are sold … then the capital gains tax will be paid and the money distributed.

The other thing is that only the people you declare as beneficiaries to that trust will get access to the income from it … and the capital in future when assets are sold.

One extra thing: if you leave money (or an income stream) to a child under 18; they will pay extreme tax rates on unearned income. This was created to prevent parents splitting their income with their kids to reduce tax. So, a child can earn up to $416 a year and pay no tax. But from $417 to $1,307 a year, they will pay 66% tax. Anything other $1307 is taxed at 45% – the tax rate the wealthiest in the country pay.

But if a child derives income from a testamentary trust, their tax miraculously is the same as working adults. In other words, the first $18,200 is tax free, from $18,201 to $45,000 a year they tax rate is just 19%. You see the advantage of that testamentary trust now? It’s good but, mind you, it’s not good enough to die for.

One last point: if you are trying to protect your assets from estranged pieces of your past, please check your superannuation fund. Given that most of us set up our super fund with our first job at age 16 or so … the chances are that you haven’t looked at the details since.

But when you signed up to the super fund, you also signed a document that asks who you want the money to go to in the event of an untimely death. Now if you (stupidly) decided the money was going to your HSC/VCE crush … or your cat named Brad Pitt (which is long dead) that is also going to cause problems. In other words, please check your super fund and make certain the money is going exactly where you want it to go. You should probably be also steering that super money towards your testamentary trust … but that’s entirely up to you and your adviser.

Of course, all of this is a moot point if you outlive the lot of them: your ex-lovers and your family. If so, good for you. Consider this lesson as an incentive to out-live them … and a form of insurance in case you don’t.

The Advantage Presents –

The SUCCESS SESSIONS

If you like what you’ve read here and want to know more about how you can take steps to improve your financial situation, you may be interested in our streaming event series – The Advantage Presents – The Success Sessions.

In each Session, learn the tips, tricks, approaches and methods that have helped our special guest speakers find financial, professional and personal success.

Our previous events are available to watch On Demand now. To find out more and receive your event pass, just click the tile above.