“PAY OFF YOUR MORTGAGE IN HALF THE TIME!”

Dealing with stressful mortgage burden is the most common reason most people don’t book their fantasy holiday, buy their dream car, finish working earlier.. or simply live free of financial stress and pressure.

Pay off your mortgage in half the time!

If it sounds too good to be true –

Please meet 4 families who are now in a great position to do exactly that.

WATCH THIS!

Meet MIRIAM and CRAIG –

To find out how Miriam and Craig dramatically improved their financial position (and maybe you could too) – CLICK THE VIDEO BELOW TO PLAY

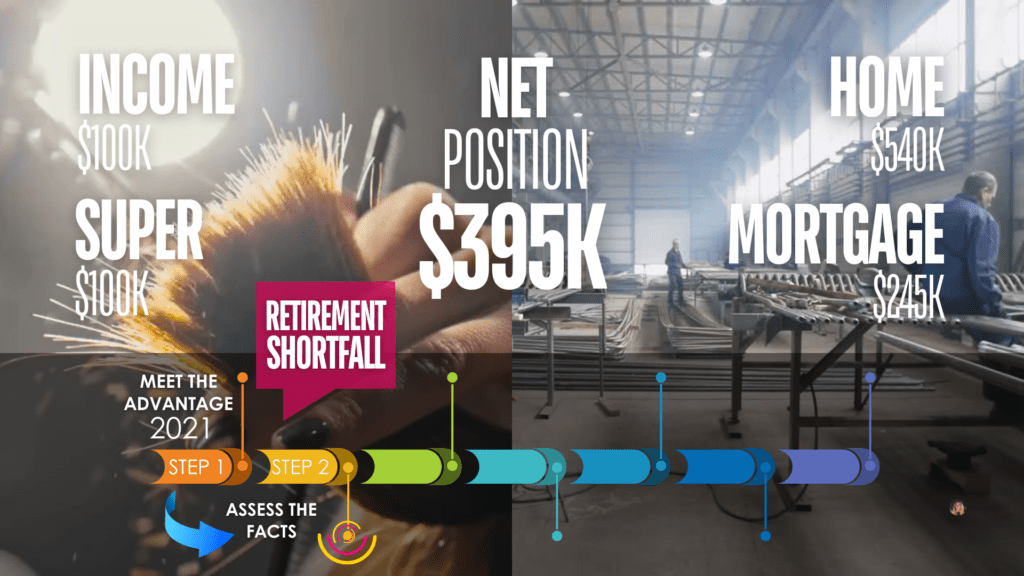

WHERE THEY STARTED

In 2020 Miriam and Craig owed $245K on their home and had credit card debts causing them stress.

Miriam and Craig aren’t high-flying investors. A hair-dresser and a factory worker, they are two hard working people who simply wanted to ask a lot of questions.

They were relieved to find a simple and straight-forward program that could help them pay their mortgage down as soon as possible.

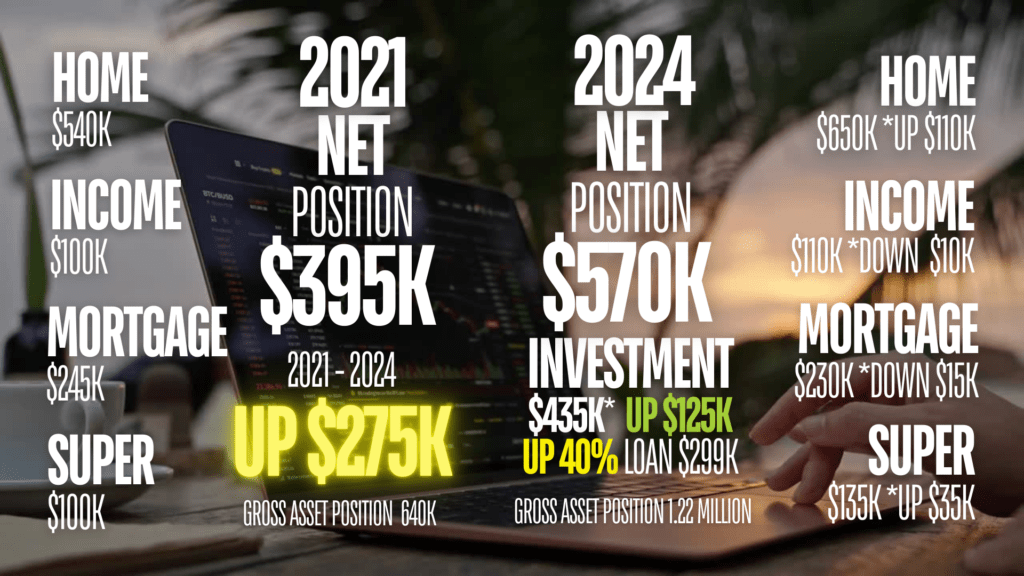

WHAT THEY DID

They found out they had $295k equity in their residential home that they could use to invest.

They also learned how to claim their hard earned tax dollars back through Government investment incentives.

They used only $39k of their home equity to invest in a property in Beaudesert in Queensland for $310K

WHERE THEY ARE NOW

4 years later, their investment is up 40% and worth $435k.

Their total net position has improved by $275K.

If they wanted to sell their investment now, they could be in a position to pay off half of their home-loan.

Meet VICTOR and DANA

To learn how they competely turned their financial circumstances around – and are now very close to being able to pay their mortage off completely – CLICK THE VIDEO BELOW

WHERE THEY STARTED

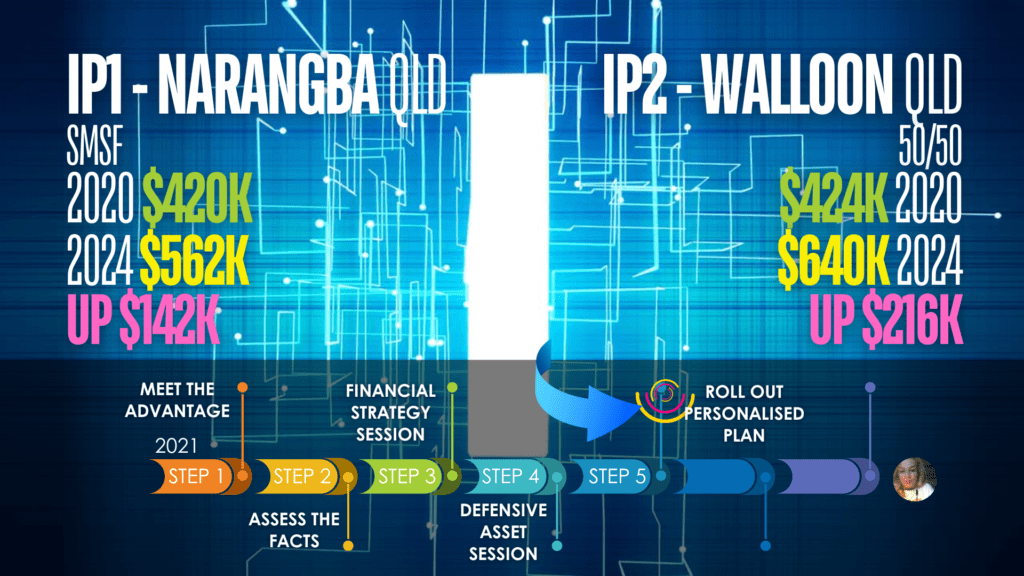

With Super + Home equity – they had a net asset position of $640k. Their concern was – If they retire at 65, they could be looking at 20 years of not working. Would they have enough in their nest-eg?

The ASFA Retirement Standards group suggests we need a minimum $73k/year in retirement for a couple – which would be $1.46 million for Victor and Dana. To maintain their current lifestyle, they learned they would want to aim for 20 x their current annual income of $130k (or $2.6 million.)

WHAT THEY DID

The Advantage connected them with experts who were able to talk them through the options that could work for them.

They learned –

- How to start investing by utlising their existing home equity

- How to restructure their Super into an SMSF they could utilise to purchase a second investment

WHERE THEY ARE NOW

As the value of the two investments improved quite dramatically – They’ve increased their overall net asset position by $473k in the last 3-4 years.

With the increase in value of their 50/50 property alone – If they decided they wanted to – they’d be fairly close to paying off the remainder of their home loan entirely.

Meet DAN and JENNY

To learn how they improved their net position by $760k, in just 8 years – CLICK THE VIDEO BELOW

WHERE THEY STARTED

Dan and Jenny had $290k in home equity and $225 in Super.

As a single income family (with 4 kids) – they were concerned they were not building a nest egg that was substantial enough for their life-long needs.

WHAT THEY DID

After to speaking to the experts we recommended – they learned how to convert their Super into a fund style they could use to invest.

They also learned how to use their existing home equity for 3 other investments (in well-researched areas) that looked promising for good growth.

NOW

WHERE THEY ARE NOW

In 8 years (with almost no outgoing fees or costs), they’ve improved their net asset position by $762k.

They are now in a position to pay down their home-loan completely and still hold on to a couple of their investments.

Meet ANGELA and TIM

To find out how Angela and Tim were able to switch lenders, get a much better rate on their home loan – and potentially save hundreds of thousands of dollars in interest payments – CLICK THE VIDEO BELOW

WHERE THEY STARTED

Most people need to get their current financial situation sorted before they can start building toward a better financial future..

Angela and Tim needed to get their mortgage under control before they could think about doing anything to start improving their financial outlook.

They had recently come through some challenging circumstances and were now paying a very high home-loan interest rate and going backwards.

WHAT THEY DID

We connected them with a specialist Mortgage Management consultant who helped them consolidate their debts – AND negotiate an improved home-loan interest rate on their behalf, with a new lender.

This dramatically decreased their minimum monthly repayment.

HOW THEY’RE TRACKING

The same expert then showed them that if they kept paying the original repayment amount each month, they could greatly reduce the term of their home loan and reduce the total amount of interest they could pay over time.

Meet THE ADVANTAGE

To learn a little more about us and how we help thousands of Australians improve their financial outlook – PRESS PLAY ON THE VIDEO BELOW

To find out if you could shave years off your mortgage, save thousands in interest payments and start feeling secure and confident about your financial future – book in for a quick, no stress chat now.

The conversation you have today will cost you nothing.. waiting years to get your mortgage in shape could cost you thousands.